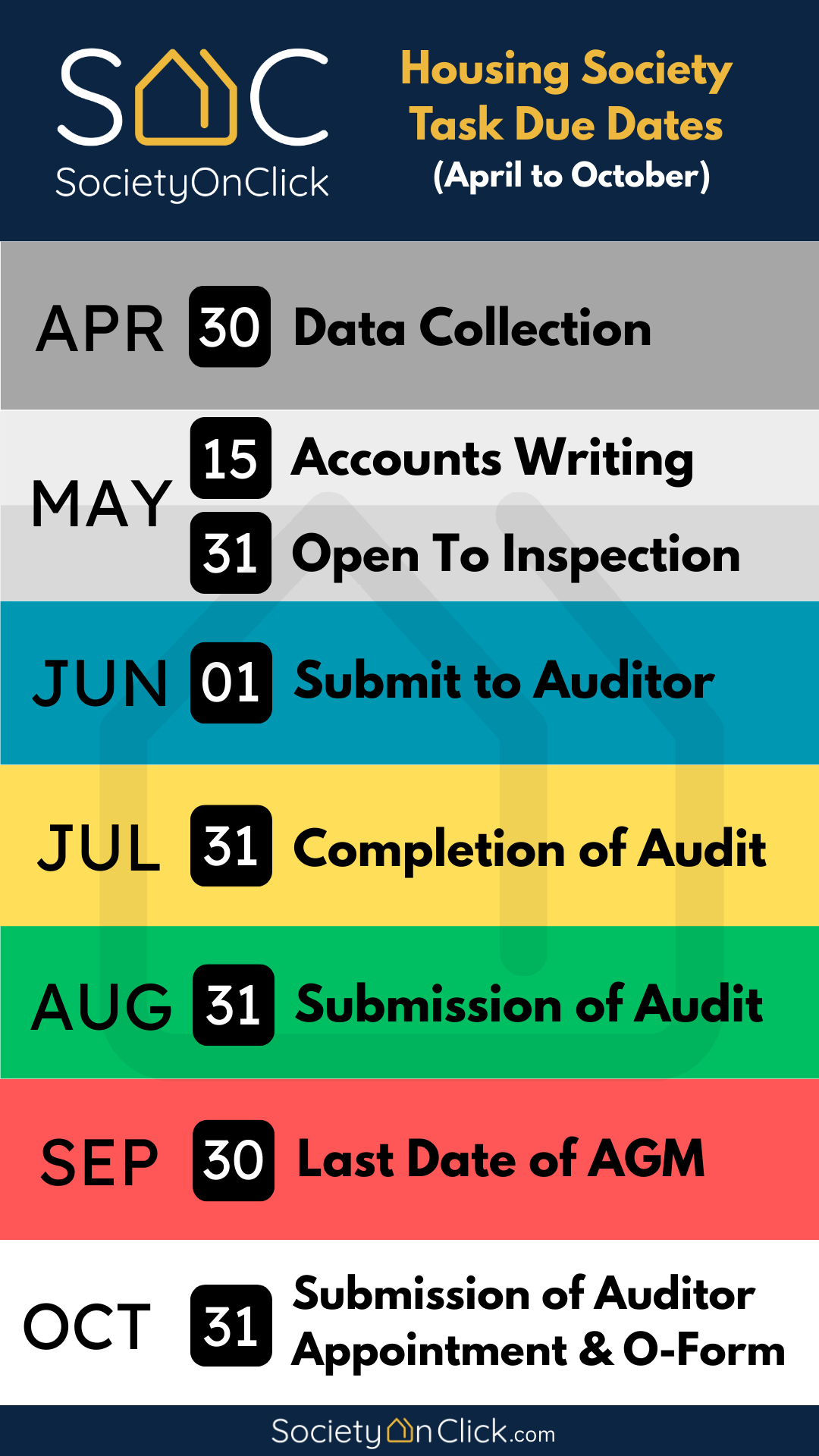

Housing Society Tasks & Due Dates (April to October)

Bye-Laws No. 146a. Closing Every Financial Year within 45 Days

The Co-operative Year in a housing society runs from April 1st to March 31st. After the financial year ends, the society must complete several essential tasks to ensure compliance with the Maharashtra Cooperative Societies (MCS) Act, 1960

The Office Bearers of a cooperative housing society play a crucial role in managing its affairs. They often juggle multiple responsibilities along with their personal and professional commitments. Despite their busy schedules, they dedicate their time to ensuring smooth operations, handling member grievances, and complying with legal obligations. Hence, 30 days of April are for the collection of data.

DATA COLLECTION – 30 DAYS

ASSETS SECTION –

Documents related to:

1. Bank & Cash Balances

2. Investments

3. Loans & Advances (Receivables/Debtors)

4. Fixed Assets

LIABILITIES SECTION –

Documents related to:

1. Share Capital & Membership Data

2. Reserves & Surplus

3. Creditors & Payables

4. Deposits Received

5. Loans & Borrowings

SUPPORTING DOCUMENTS –

2. Write-Off / Write-back, if any, with supporting AGM Minutes

3. Subscriptions, if any, with receipts

4. AMC payments with a period of contract documents.

5. Building Insurance payment/period with policy documents

6. Receipt of Education and Training Fund

7. Property Tax, NA Tax, Lease Rent – Payment receipts

ACCOUNTS WRITING – 15 DAYS

– Income & Expenditure Statement: N-FORM (Rule-62)

– Balance Sheet: N-FORM (Rule-62)

– Other Finalization Reports

2. Taxation & Compliance

– Deduct and file TDS Returns for vendors and staff

– File GST Returns (if applicable)

3. Billing & Member Dues Management

– Generate and issue maintenance bills for the new financial year.

– Update the list of outstanding dues & defaulters.

OPEN TO INSPECTION – 15 DAYS

As per MCS Rule 61, these statements of accounts shall be open to inspection by any member during office hours at the office of the society, and a copy thereof shall be submitted, within fifteen days from the date of preparation, to the auditor appointed by the Society of the Registrar for the audit of that society.

It has been found that the financial statement prepared by the housing society accountant is usually approved in the managing committee meeting and submitted to an auditor appointed by the AGM of the society or the Registrar.

AUDIT – 60 DAYS – SUBMISSION TO COMPLETION OF AUDIT

Key Provisions of Section 81:

1. Mandatory Annual Audit:

– Every co-operative society must undergo an annual audit of its accounts.

– The audit must be conducted by a certified auditor from the panel approved by the State Government.

2. Scope of the Audit:

– Verification of Final Accounts.

– Checking of cash, assets, liabilities, funds, and investments.

– Ensuring dues collection, outstanding payments, and proper accounting.

– Examining loans, borrowings, and member transactions.

3. Audit Report (Form N-1) & Observations:

The auditor must submit an Audit Report (Form N-1) with observations:

– Financial position of the society.

– Statutory compliance under the MCS Act, 1960 & Rules, 1961.

– Any irregularities, fraud, or mismanagement found during the audit.

– If serious irregularities are found, they must be reported to the Registrar.

SUBMISSION OF AUDIT REPORT – 30 DAYS

Section 81(5B) in The Maharashtra Co-Operative Societies Act, 1960

(5B) The auditor shall submit [his audit report within a period of one month from its completion and in any case before issuance of notice of the annual general body meeting,] [Sub-sections (5A) and (5B) were inserted, by Maharashtra 10 of 1988, Section 43(e).] to the society and to the Registrar in such form as may be specified by the Registrar, on the accounts examined by him and on the balance sheet and profit and loss account as on the date and for the period up to which the accounts have been audited, and shall state whether in his opinion and to the best of his information and according to the explanation given to him by the society the said accounts give all information required by or under this Act and present the true and fair view of the financial transaction of the society.]:

LAST DATE OF AGM – 30 DAYS

As per Section 75(2) of the MCS Act, 1960, the last date for conducting the Annual General Meeting (AGM) of a Co-operative Housing Society is September 30th.

“Every co-operative society shall hold its Annual General Meeting (AGM) within six months from the end of the financial year, i.e., on or before September 30th each year.“

AUDITOR APPOINTMENT & O-FORM SUBMISSION – 30 DAYS

– Appoint a Statutory Auditor in the Annual General Meeting (AGM).

– Select an auditor from the government-approved panel (as per GR).

– Submit the appointment details in Form O to the Registrar of Co-operative Societies.

As per Section 82 of the MCS Act, 1960, a society must:

– Form O is the prescribed format for submitting the Audit Rectification Report to the Registrar.

– Rectify all audit remarks & objections raised in the Audit Report (Form N-1).

– Submit Form O to the Registrar within 3 months from receiving the audit report.

Managing a housing society’s accounts can be complex and time-consuming. With SocietyOnClick.com, you get professional, accurate, and hassle-free accounting services tailored specifically for cooperative housing societies. From maintaining financial records (Form N), preparing audit reports (Form N-1), and filing TDS & GST to ensuring compliance with MCS Act regulations, we handle it all !

– Expert Accounting & Compliance

– Timely Audit & Financial Reporting

– Error-Free Billing & Dues Management

– Statutory Compliance as per MCS Act, GST & Income Tax Laws

Choose SocietyOnClick.com for stress-free housing society accounting with 100% statutory compliance!

CONTACT US TODAY

TO STREAMLINE YOUR SOCIETY’S FINANCES!

– VIJAY MANJAREKAR

Send a Message

Contact Us

Phone

+91 9867751789

hello@societyonclick.com