PAN (Permanent Account Number) Explained

History of PAN (Permanent Account Number) Card in India

India’s PAN (Permanent Account Number) system has evolved over several decades as a crucial tool for tracking financial transactions and ensuring tax compliance. Below is a brief history of its development:

Pre-PAN Era (Before 1972):

Before the introduction of PAN, the Income Tax Department assigned manual numbers to taxpayers, which varied from region to region. There was no central database, leading to duplication, errors, and difficulty in tracking tax evasion.

Before the introduction of PAN, the Income Tax Department assigned manual numbers to taxpayers, which varied from region to region. There was no central database, leading to duplication, errors, and difficulty in tracking tax evasion.

Introduction of General Index Register (GIR) Number (1972):

The GIR Number was introduced as a taxpayer identification system. However, it was a manual, region-based system, and multiple people could have the same GIR number in different locations. There was no unique identification at the national level, making it difficult to track financial transactions.

The GIR Number was introduced as a taxpayer identification system. However, it was a manual, region-based system, and multiple people could have the same GIR number in different locations. There was no unique identification at the national level, making it difficult to track financial transactions.

Birth of PAN (1976):

In 1976, the concept of the Permanent Account Number (PAN) was introduced to bring uniformity and efficiency in tax administration. Initially, PAN was manually allotted, and there was no centralized database.

In 1976, the concept of the Permanent Account Number (PAN) was introduced to bring uniformity and efficiency in tax administration. Initially, PAN was manually allotted, and there was no centralized database.

Introduction of the Modern PAN System (1995-1996):

The Income Tax Department revamped the PAN system to make it a centralized, unique number across India. A structured 10-character alphanumeric format was introduced. The first five characters were alphabets, followed by four numbers, and ended with one alphabet.

The Income Tax Department revamped the PAN system to make it a centralized, unique number across India. A structured 10-character alphanumeric format was introduced. The first five characters were alphabets, followed by four numbers, and ended with one alphabet.

Computerization and Mandatory PAN (1999-2004):

In 1999, the PAN system was fully digitized with the help of NSDL (National Securities Depository Limited) and UTIITSL (UTI Infrastructure Technology and Services Limited). PAN became mandatory for tax filing, bank transactions, and high-value financial transactions.

In 1999, the PAN system was fully digitized with the help of NSDL (National Securities Depository Limited) and UTIITSL (UTI Infrastructure Technology and Services Limited). PAN became mandatory for tax filing, bank transactions, and high-value financial transactions.

PAN Becomes Essential for Financial Transactions (2005-Present):

2005: PAN became mandatory for opening bank accounts, buying property, investing in mutual funds, and large cash deposits.

2010: Introduction of e-PAN for faster digital issuance.

2017: Linking of PAN with Aadhaar was introduced to prevent duplication & fraud.

2018: A QR Code was added to PAN cards for easy verification.

2020: Instant PAN allotment based on Aadhaar verification was launched.

2005: PAN became mandatory for opening bank accounts, buying property, investing in mutual funds, and large cash deposits.

2010: Introduction of e-PAN for faster digital issuance.

2017: Linking of PAN with Aadhaar was introduced to prevent duplication & fraud.

2018: A QR Code was added to PAN cards for easy verification.

2020: Instant PAN allotment based on Aadhaar verification was launched.

PAN in the Digital Age(2025:

Today, PAN is a crucial document for taxation, financial transactions, and identity verification. With initiatives like e-PAN, Aadhaar linking, and digital KYC, the government aims to make tax compliance easier and prevent tax fraud.

Today, PAN is a crucial document for taxation, financial transactions, and identity verification. With initiatives like e-PAN, Aadhaar linking, and digital KYC, the government aims to make tax compliance easier and prevent tax fraud.

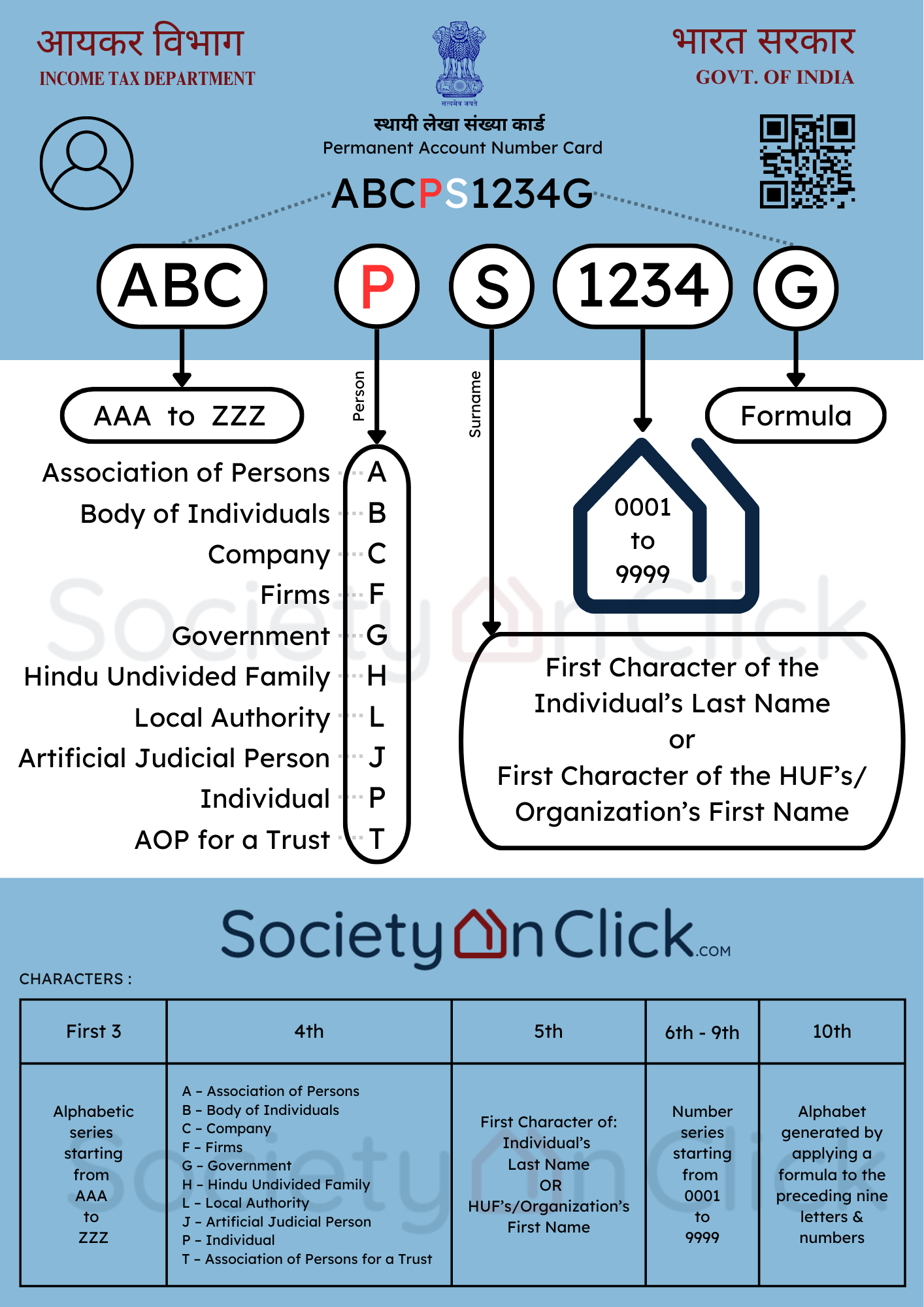

Let us now understand the composition of the Permanent Account Number. How is this unique number created and what does each of its characters stand for?

Understanding the Permanent Account Number (PAN)

A PAN (Permanent Account Number) Card issued by the Income Tax Department of India contains important details that help in tax-related transactions. Here’s how to read a Permanent Account Number (PAN):

AAAAA9999A (10 characters)

First 5 characters (Alphabetic):

The first three letters are random combinations of alphabets from AAA to ZZZ

The fourth letter represents the type of taxpayer:

P – Individual (Person)

C – Company

H – Hindu Undivided Family (HUF)

F – Firm/Partnership

A – Association of Persons (AOP)

T – Trust

B – Body of Individuals (BOI)

G – Government

L – Local Authority

J – Artificial Juridical Person

The fifth letter is the first character of the surname (for individuals) or the first character of the entity name (for non-individuals).

Next 4 characters (Numeric) are random combinations of numbers from 0001 to 9999

Last character (Alphabetic) is a calculated check-sum character based on the preceding 9 characters.

Components of the PAN Card

Let’s understand each element on the Front Side of PAN Card:

Name of the Cardholder:

For individuals – Full name (as per PAN records)

For non-individuals – Entity/Company/Organization Name

For individuals – Full name (as per PAN records)

For non-individuals – Entity/Company/Organization Name

Father’s Name (Only for Individuals):

Only applicable for individual PAN holders, including married women

Only applicable for individual PAN holders, including married women

Date of Birth (For Individuals) / Date of Incorporation (For Entities):

Format: DD/MM/YYYY

For companies and firms, this is the date of registration/incorporation.

Format: DD/MM/YYYY

For companies and firms, this is the date of registration/incorporation.

Signature:

The cardholder’s signature is used for verification purposes.

The cardholder’s signature is used for verification purposes.

Photograph:

Present only on individual PAN cards

Present only on individual PAN cards

Hologram (Security Feature):

Tamper-proof hologram of the IT Department.

Tamper-proof hologram of the IT Department.

QR Code:

Encoded details of the PAN card for verification via scanners.

Encoded details of the PAN card for verification via scanners.

Issuing Authority :

The card is issued by NSDL (Protean eGov Technologies Ltd.) or UTIITSL (UTI Infrastructure Technology and Services Limited) on behalf of the Income Tax Department

The card is issued by NSDL (Protean eGov Technologies Ltd.) or UTIITSL (UTI Infrastructure Technology and Services Limited) on behalf of the Income Tax Department

PAN Card – Your key to financial identity!

– VIJAY MANJAREKAR

DISCLAIMER: Please note that this article is presented from the writer’s point of view. If any individual would like to gain more clarity on the subject matter, they should visit the official income tax website resources.

Send a Message

Contact Us

Phone

+91 9867751789

hello@societyonclick.com