File in Time, Save the Fine – File Housing Society Tax Return on Time!

History of FD Interest Taxation

Prior to 1st April 2021, the interest earned on Fixed Deposit invested in a Co-Operative Bank could be fully credited to the beneficiary (Co-Operative Housing Society’s) account by filling a self-declaration Form 15G. This form had to be submitted by the taxpayer to the bank requesting not to deduct TDS on interest income on the grounds that either their income was below the basic exemption limit or the tax calculated on their total income was Nil.

There was a lack of awareness about Income Tax returns for Co-Operative Housing Societies, since principle of mutuality was believed to be applicable to its income.

A co-operative society is a mutual association in which the members of the group come together for a common objective, make contributions for achieving that objective and participate in the surplus arising out of it. In respect of contributions from members, concept of mutuality would be applicable. Surplus arising out of contributions would be covered by concept of mutuality and therefore not an income at all. In that case, either the complete income or at least a majority was assumed to be exempted from taxation resulting in very few or no IT-Returns filed by housing societies.

Hence, housing societies used to enjoy the entire Interest earned from Fixed Deposits kept with Co-operative Banks prior to crucial changes in the Income Tax rules. So exactly what changed?

Change in Income Tax Rule

On 31st March 2021, MINISTRY OF FINANCE (Department of Revenue) (CENTRAL BOARD OF DIRECT TAXES) New Delhi, issued a Notification to change the Return of income and Return of fringe benefits rules in the Income-tax Rules, 1962 (principal rules), in rule 12 sub-rule (1).

The said notification omitted the word “OR” from the three clauses where the total income includes income chargeable to income-tax, under the head;

- “Salaries” or income in the nature of family pension as defined in the Explanation to clause (iia) of section 57; OR

- “Income from house property”, where assesse does not own more than one house property and does not have any brought forward loss [or loss to be carried forward] [Inserted by the Income-tax (Second Amendment) Rules, 2018, w.r.e.f. 1-4-2018.] under the head; OR

- “Income from other sources”, except winnings from lottery or income from race horses and does not have any loss under the head, be in Form SAHAJ (ITR-1) and be verified in the manner indicated therein:

- is a person in whose case tax has been deducted under section 194N; or

- is a person in whose case payment or deduction of tax has been deferred under sub-section (2) of section 191 or sub-section (1C) of section 192;”

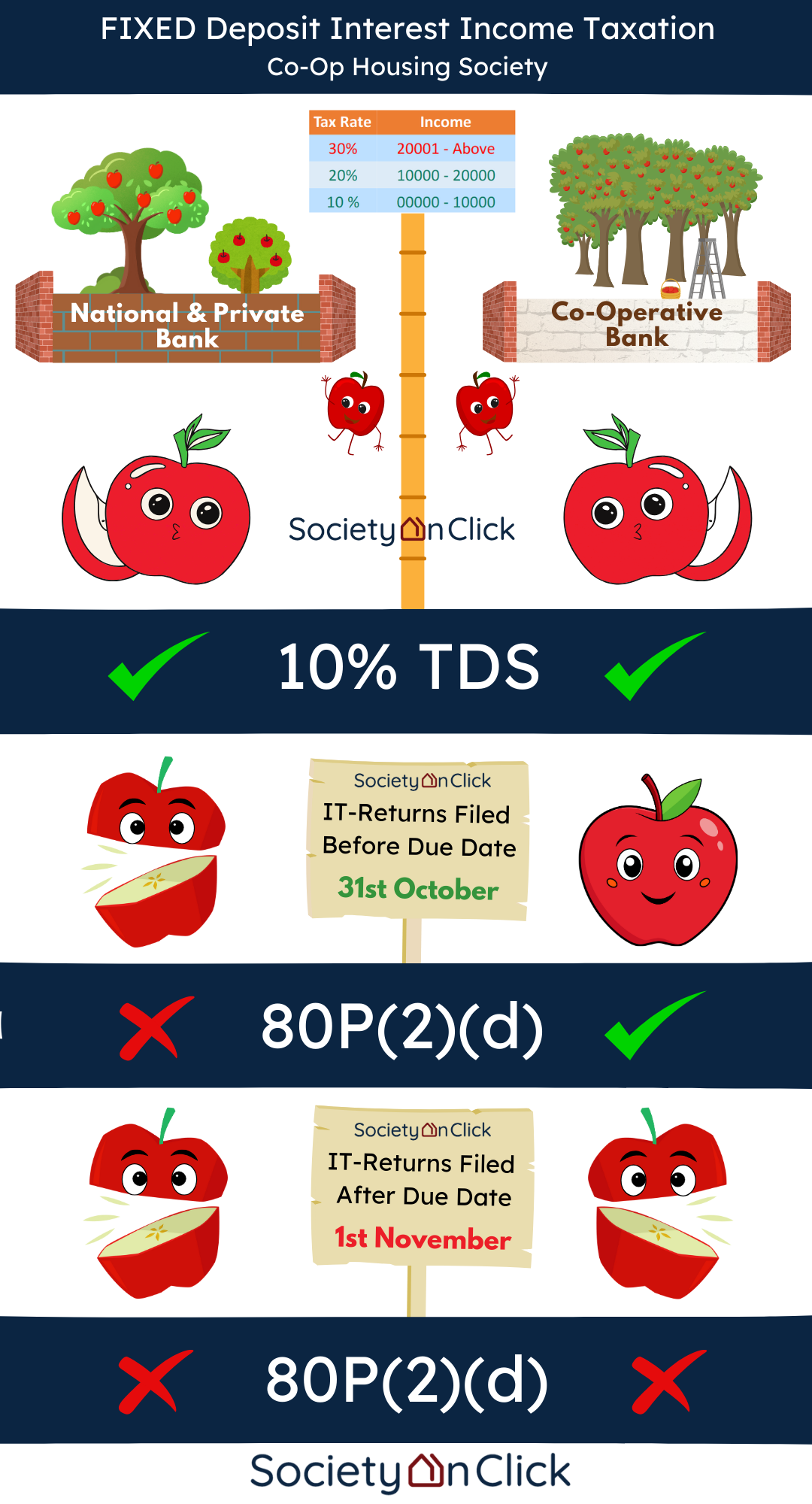

Due to the above changes in Income Tax Rule, all banks including Co-Operative Banks were mandated to deduct 10% TDS on every interest paid on Investments or Fixed Deposits maintained by Cooperative Housing Societies.

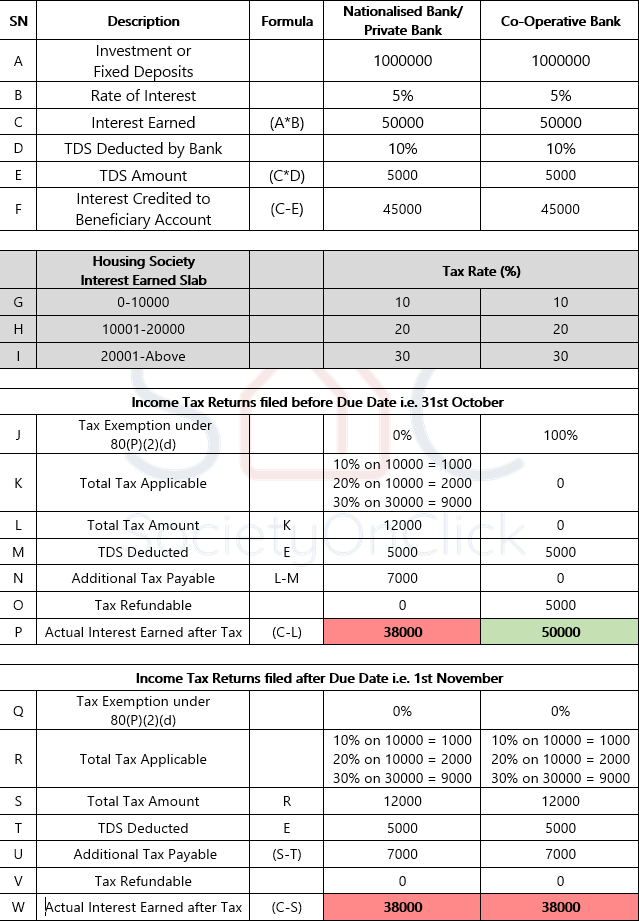

Let’s Understand with an Example:

On 31st March 2021, MINISTRY OF FINANCE (Department of Revenue) (CENTRAL BOARD OF DIRECT TAXES) New Delhi, issued a Notification to change the Return of income and Return of fringe benefits rules in the Income-tax Rules, 1962 (principal rules), in rule 12 sub-rule (1).

* For simpler representation of the core concept, additional variable factors such as cess and interest due to non-payment of Advance Tax is not shown

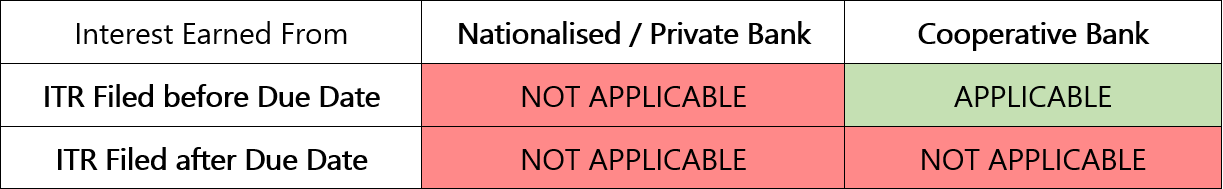

FD Interest Taxation Summary

- the source of the interest earned (Nationalised / Private Bank or Cooperative Bank) and;

- when the society files the ITR (before or after the due date).

Keep In Mind

Interest Income Taxability:

- Remember that interest income earned by a cooperative housing society from bank fixed deposits or investments is taxable under the Income Tax Act, 1961, unless specific exemptions apply.

Section 80P Benefits:

- Societies can claim deductions under Section 80P(2)(d) for interest income earned from investments made only in cooperative banks.

- However, interest from banks such as Nationalised and Private Banks do not qualify for this exemption.

TDS Applicability:

- Tax Deducted at Source (TDS) at 10% is applicable if the interest income exceeds ₹40,000 in a financial year. Societies can claim a refund or adjustment while filing their ITR.

Record Keeping:

- Maintain a clear record of interest income and its source (Nationalised bank, Private Bank or Co-Operative Bank).

Reporting and Compliance:

- All interest income, whether taxable or exempt, must be accurately reported in the society’s ITR (Form ITR-5).

- Filing returns on time and maintaining proper records (e.g., interest certificates, TDS statements) is crucial to avoid penalties.

Strategic Planning:

- To optimize tax liability, societies should consider investing in cooperative banks rather than other banks, ensuring eligibility for Section 80P deductions.

Seek Professional Advice:

- Consult a tax expert or CA to ensure compliance and explore tax-saving opportunities.

Hence, cooperative housing societies must assess the source of their interest income to determine its taxability, claim applicable deductions, and ensure compliance with tax laws to minimize their financial burden.

Money Saved is Money Earned

– VIJAY MANJAREKAR

DISCLAIMER: Please note that this article is presented from my point of view. If any individual would like to gain more clarity on the subject matter, they should visit the official income tax website resources.

Send a Message

Contact Us

Phone

+91 9867751789

hello@societyonclick.com